|

Farm Income Still On The Upswing

SARA WYANT

WASHINGTON, D.C.

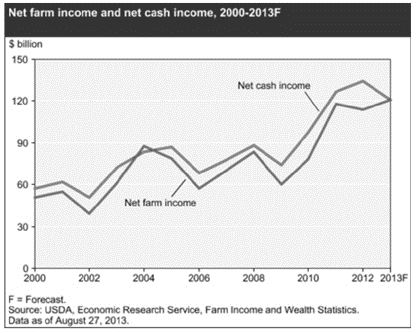

Despite droughts, floods and other weather-related problems, USDA says things are still looking pretty good down on the farm. This year, farm income could reach $120.6 billion in 2013, up 6 percent from 2012’s estimate of $113.8 billion, but down $7.6 billion (6.3 percent) in net farm income from the agency’s February forecast of $128.2 billion.

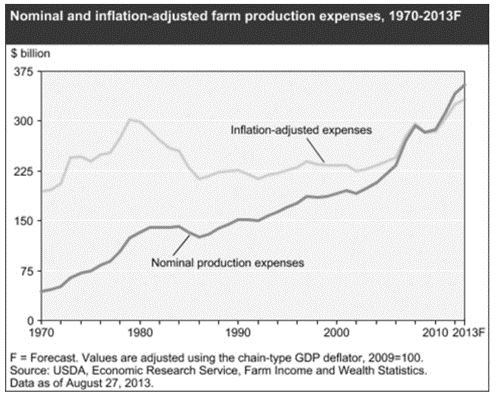

After adjusting for inflation, 2013’s net farm income is expected to be the second highest since 1973, according to a new report by USDA’s Economic Research Service (ERS). That’s despite the fact that 2013 production expenses are also expected to be the highest on record.

An anticipated return to trend yields could lead to bumper corn and soybean crops, pumping up year-end crop inventories, while driving down crop cash receipts by 5.5 percent – the first decline since 2009. But that’s relatively good news for the livestock sector.

The value of livestock, dairy, and poultry production is expected to increase over 5 percent in 2013, reflecting large gains in broiler and milk sales.

The annual average price for broilers is expected to rise almost 11 cents per pound (22 percent) in 2013. Broiler receipts will also benefit from a small, expected increase in volume sold, while broiler exports are expected to increase almost 3 percent.

Milk receipts in 2013 are forecast to exceed the previous high set in 2011. The annual price of milk is expected to increase over $1 per cwt. from 2012; at $19.70 per cwt, it could be the second highest on record. Milk production is expected to be about 1 percent above 2012 and 3 percent above 2011. U.S. milk exports are expected to increase 17 percent in 2013.

However, net cash income – which measures the difference between cash expenses and the combination of commodities sold during the calendar year, plus other sources of farm income – is headed down more than 10 percent from 2012 and is forecast at $120.8 billion.

Even so, USDA’s ERS notes that 2013’s forecast would be the fourth time net cash income, after adjusting for inflation, has exceeded $100 billion since 1973.

As many crop prices trend downward, farm expenses continue to increase. ERS projects a $13.1-billion increase in total expenses in 2013, to $354.2 billion, continuing a string of large year-to-year movements that have taken place since 2002. Rent, labor, and feed are the expense items expected to increase the most in 2013.

Expected lower prices in 2013 mean cash receipts are forecast to decline significantly from 2012 for four major commodities: corn, soybeans, cotton (lint and seed), and peanuts.

Here are other highlights from the ERS report:

• Lower corn receipts reflect an anticipated fall in 2013’s average price ($5.85 per bushel) from its record-high price in 2012. The forecast price decline more than offsets an anticipated increase in the quantity of corn sold in 2013, with bushels sold expected to be the third highest on record.

• While U.S. soybean production and use are both expected to increase in marketing year 2013, expectations for lower soybean receipts reflect lower prices more than offsetting a slight increase in quantities sold. Value of peanut production is expected to drop 38 percent in 2013, reflecting both lower prices and quantities sold.

• Food grain receipts are expected to remain relatively stable. A forecast decline in the price of wheat in 2013 will be mostly offset by an increase in quantity sold. Rice receipts are expected to remain stable due to higher prices and lower sales.

• Cotton receipts (lint and seed) are expected to decline in 2013 from their record 2012 level, reflecting large declines in both supply of and demand for cotton. A decline in cottonseed receipts will be mostly offset by an expected rise in open-market sales of cotton lint. The large decline predicted in cotton cash receipts from 2012 to 2013 is almost entirely due to a large decline in receipts from placements and redemptions of lint with the Commodity Credit Corporation, especially in the fourth quarter of 2012. U.S. cotton sales are especially dependent on world demand for U.S. cotton, which has been declining sharply and reducing U.S. cotton exports.

• Vegetable and melon receipts are expected up 17 percent in 2013, mainly due to higher prices (excluding dry beans). Receipts for potatoes are expected to increase due to increased sales and a higher average price in 2013. While sales of dry beans are expected to increase, a forecast price decline leads to lower dry bean receipts. Large production gains are expected for peaches, prunes, and plums in 2013, with more modest increases expected for apples, pears, strawberries, grapefruit, and lemons. Large production declines are forecast for avocados and sweet cherries, with smaller but substantial declines in the production of oranges and almonds.

Farm sector assets, debt, and equity are all forecast to increase in 2013. As in the last several years, increases in farm asset value are expected to exceed increases in farm debt, with farm real estate the main driving force. Confirming the strength of the farm sector's solvency, both the debt-to-asset ratio and debt-to-equity ratio are expected to reach historic lows.∆

SARA WYANT: Editor of Agri-Pulse, a weekly e-newsletter covering farm and rural policy. To contact her, go to: http://www.agri-pulse.com/

|

|