|

Recent History: The Cost Of A Fall Purchased Stocker Cattle

DR. ANDREW P. GRIFFITH

KNOXVILLE, TENN.

Risks abound in the stocker cattle business. For fall stocker purchases, there are three major risks to navigate and two of them are immediate. The first major risk is the price when purchasing the animals. The second risk is October, also known as “Stocker Obituary” month (picture not provided), and the third major risk is the price at time of marketing. Since this is the beginning of October and there are others with higher quality training in animal health, the focus of this article is stocker purchase price and marketing price. This information could also be useful to cow-calf producers making marketing decisions this fall.

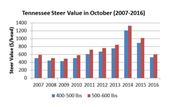

The accompanying graph illustrates total calf value in Tennessee during the month of October from 2007 to 2016. It should be noted, November calf values are similar to October calf values. The chart illustrates 400 to 500 pound steer values have ranged from $432 per head to $1,212 per head over the past several years with an average value of $658 per head the past ten years. Similarly, 500 to 600 pound steer values have ranged from $492 per head to $1,332 per head with a ten year average of $746 per head.

At the time of this article being written, mid-September, 450 pound steers were valued at $680 per head while 550 pound steers were valued at $775 per head in Tennessee. If calf prices were to hold this value through October then only 2013 through 2015 would have had higher prices in October. However, a $2 to $3 per hundredweight price decline would result in calf values below October 2012 values. Though many cow-calf producers would prefer higher calf prices, from a stocker producer standpoint, lower prices reduce financial risks and free up capital for the purchase of more animals.

The fall of 2016 and the spring of 2017 were very kind to stocker producers as calf prices plummeted in the fall of 2016 and then gained strength throughout the first several months of 2017. The relatively low purchase prices, inexpensive cost of gain, and higher prices in the spring resulted in many producers experiencing $300 to $500 per head profits. The question is if a similar scenario will play out the next six to eight months.

The probability of calf values dipping as low in October 2017 as they did in October 2016 is very small. However, it is possible for 450 pound steer values to drop below $640 per head and 550 pound steer values to fall below $735 per head during the months of October and November. If such a price decline was experienced in October, it would result in producers paying $110 to $130 more per head for steers than one year ago, but it does not cause the financial stress it did in 2014.

The sell value in the spring is a little tougher to prognosticate given it is five to six months down the road. However, the futures market appears to be pricing in a value of gain just above $1. This means a producer who can make it through the risk of calf morbidity and mortality has an opportunity to profit from stocker cattle this fall if the cost of gain remains intact. It does appear profits of $100 per head or better will be achievable. The early 2018 feeder cattle market is not as likely to see a price run as strong as the spring of 2017, but there does remain some optimism for prices to improve from current levels which could further enhance profitability. There are no guarantees implied by this expectation which means producers should watch the market closely.

It may be important to mention that this article is not written to encourage or discourage cattle producers from undertaking the stocker cattle business. This article is meant to outline the prospects of a fall calf purchase and a spring marketing of feeder cattle. Before entering the stocker cattle business, it is important to understand the risks and pitfalls that can arise. Even the most senior stocker producers are faced with challenges that catch them off guard at times. ∆

DR. ANDREW P. GRIFFITH: Assistant Professor, Department of Agricultural and Resource Economics, University of Tennessee

|

|